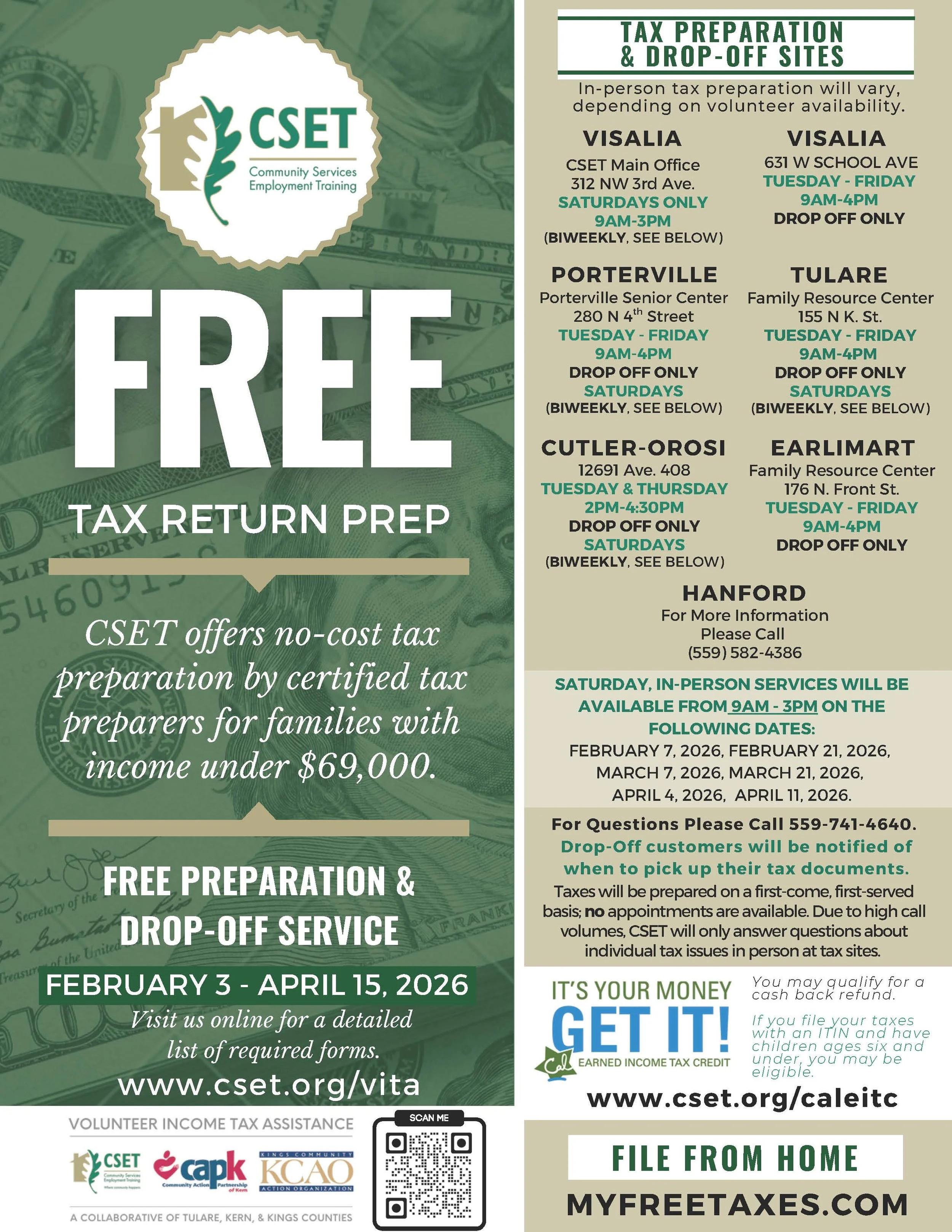

Free Tax Preparation Begins Feb. 3, 2026

CSET provides free tax preparation services for families with household income less than $69,000. You may also qualify for the Federal and State Earned Income Tax Credit. You can have your taxes done in person at one of the sites below, drop off your taxes for preparation, or do them from home!

FREE TAX PREPARATION

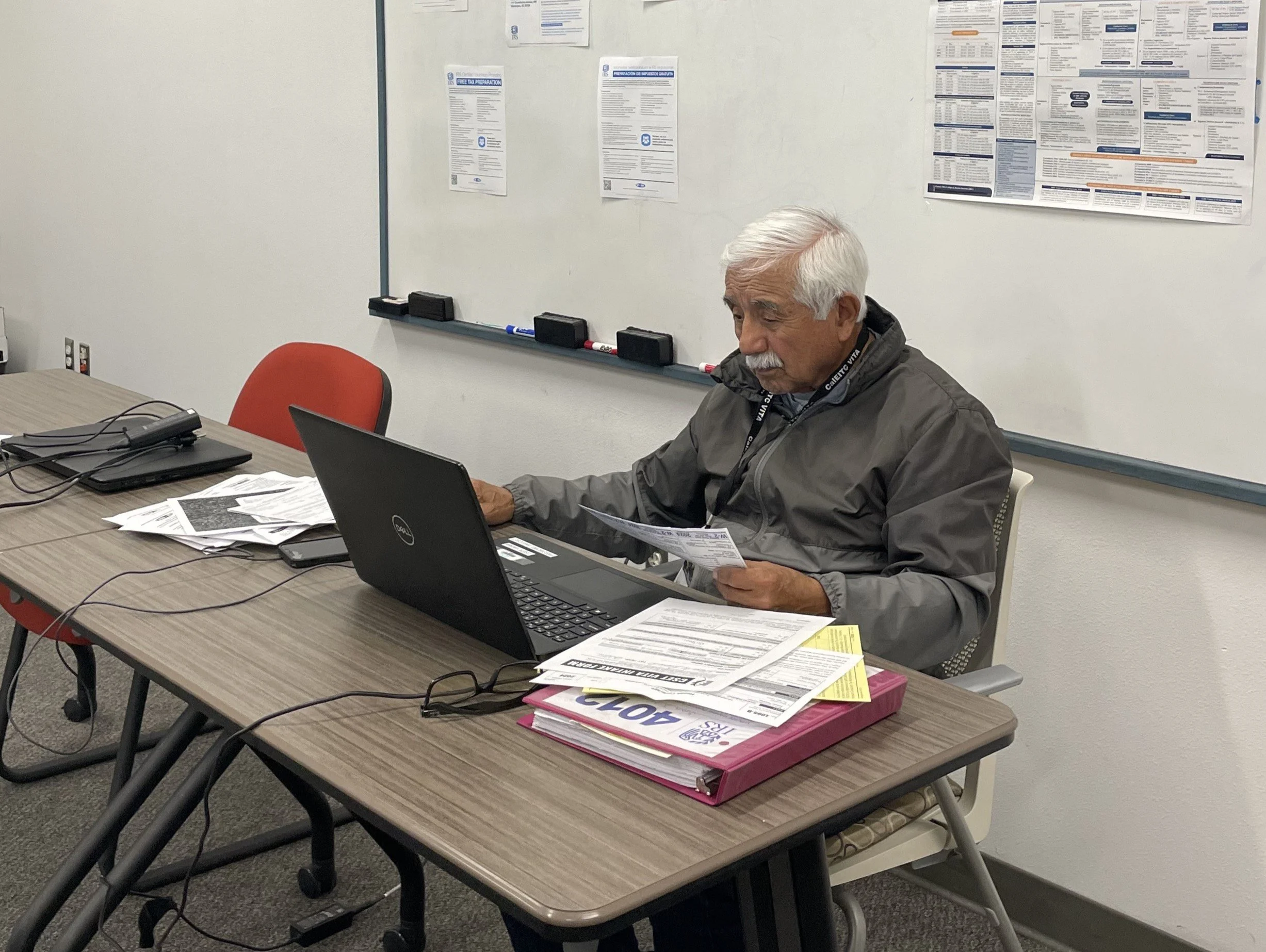

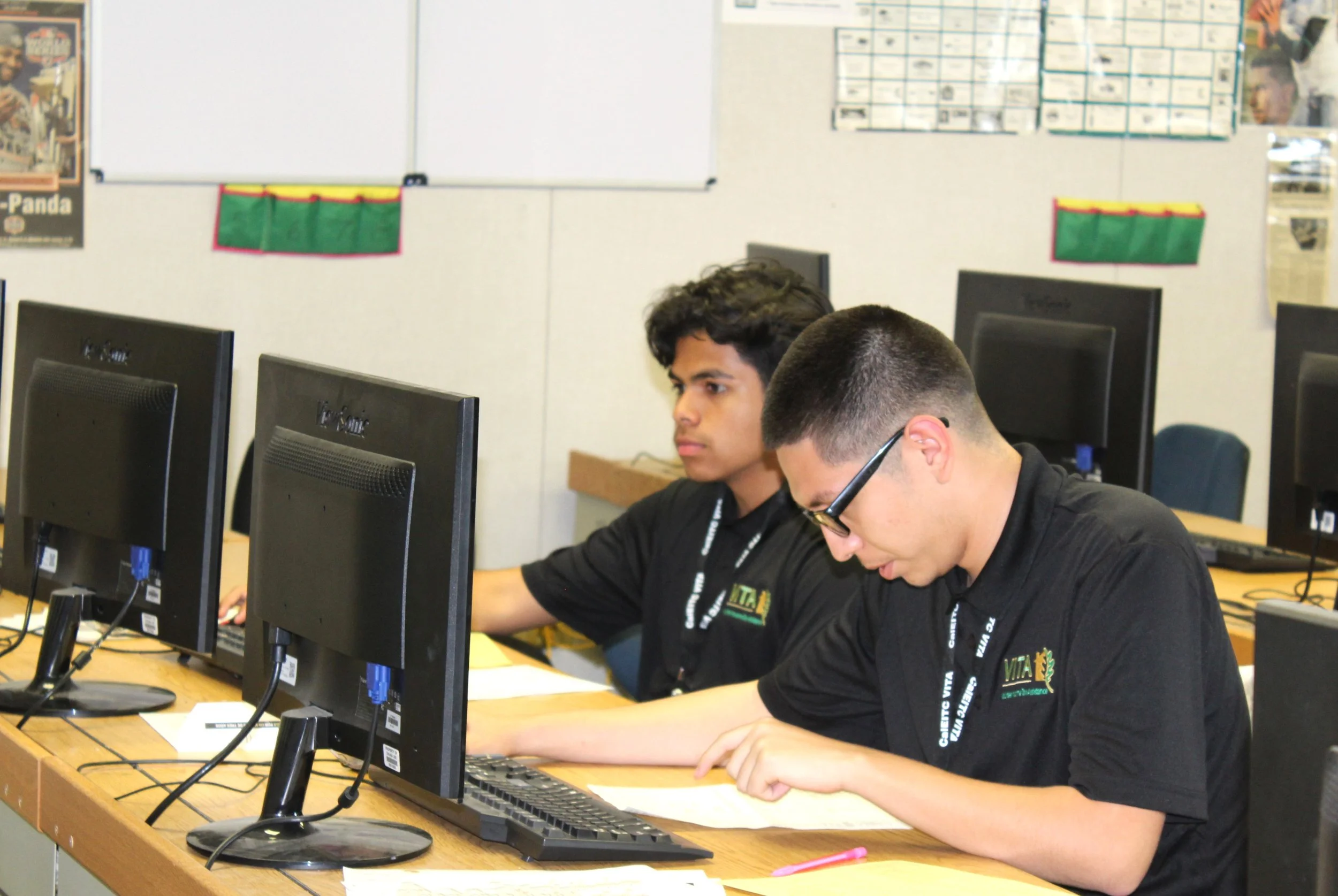

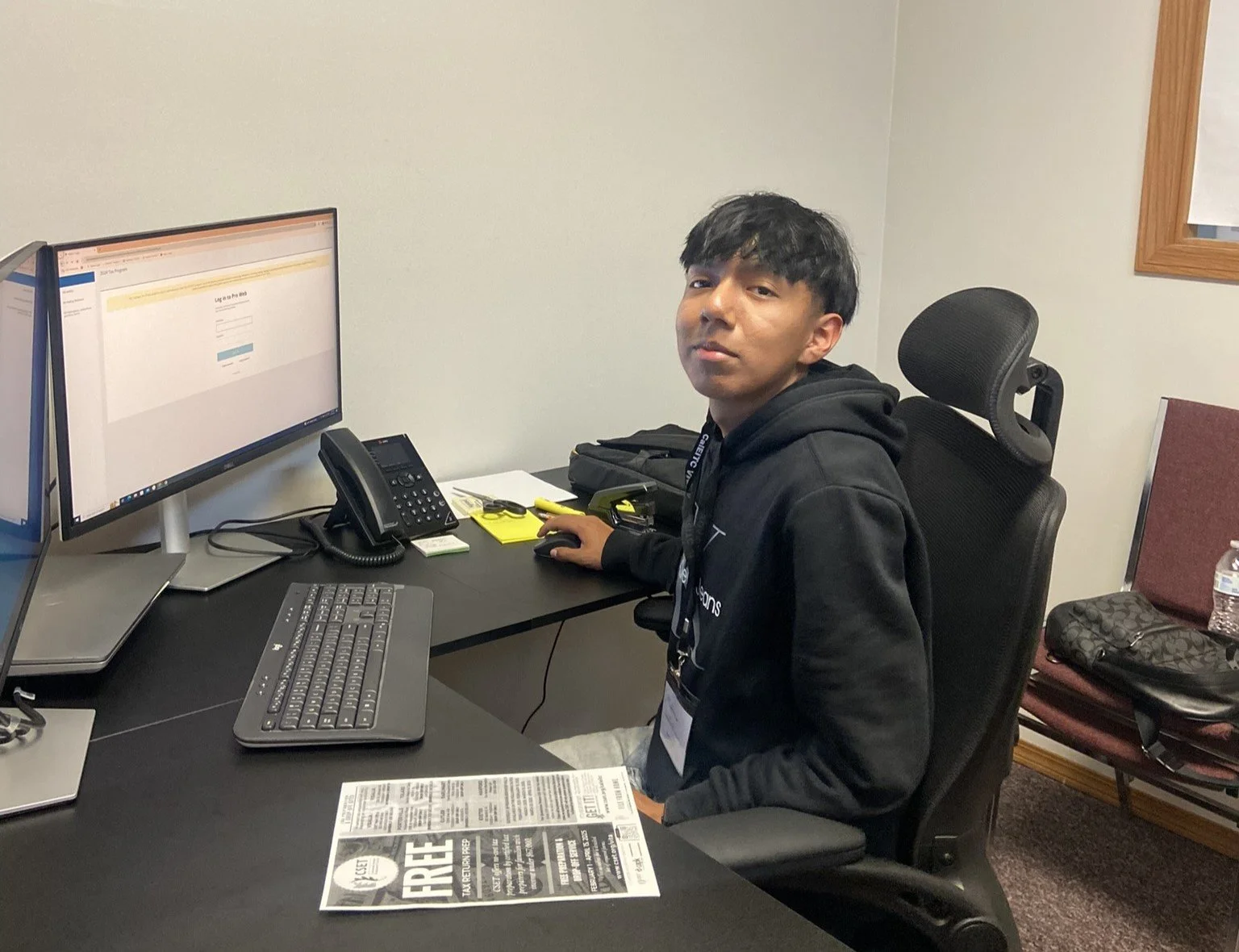

Each year, CSET helps thousands of residents prepare and file their income tax returns for free through the Volunteer Income Tax Assistance (VITA) program. VITA is available to low- and moderate-income individuals and families with a household income less than $69,000. Federal and state tax returns are filed by certified volunteer tax preparers who generously donate their time to this impactful community program. The VITA program is made possible by a strong partnership between the IRS and CSET.

There are three easy ways to get your taxes done! Visit one of our in person sites throughout the County, drop off your documents and we’ll call you when your taxes are done, or you can do your taxes at your own pace by using www.myfreetaxes.org.

VITA services are available now through April 15. For questions please call (559) 741-4640.

BECOME A VITA VOLUNTEER

It’s not too late to become a VITA volunteer! Your support will help inform Tulare County families about eligible cash-back tax credits, including the state and federal Earned Income Tax Credit (EITC). Whether you're a retired financial professional or an individual exploring a career in the finance industry, your participation as a volunteer would be highly valuable.

FILE FROM HOME

Starting in January 2026, you can easily file your return online. Click on the myfreetaxes.org button below to file. It's easy, safe, secure and 100% Free!

Kings County residents can contact KCAO’s VITA at (559) 904-8854 to file their taxes for free.

Kern County residents can contact CAPK’s VITA by dialing 2-1-1 to file their taxes for free.

2025 Community Impact

IT'S YOUR MONEY, GET IT

In 2015, Governor Jerry Brown and the state legislature created the first-ever California Earned Income Tax Credit (CalEITC). California joined 24 other states and the District of Columbia in adopting a state EITC to supplement the federal EITC.

In 2020, Governor Gavin Newsom expanded CalEITC and added the new Young Child Tax Credit (YCTC) to further assist families facing poverty. Taxpayers who file their tax returns with an ITIN (Individual Taxpayer Identification Number) including undocumented immigrants, are eligible for the CalEITC and the Young Child Tax Credit (YCTC) when filing their taxes.